Want to learn how to evaluate a company’s stock like a pro? Discover the importance of market capitalisation, and how to use this metric to build a portfolio that aligns with your financial goals and risk tolerance level.

Image by Freepik

When you want to buy a new phone, you might look at certain standard specifications that would help you make the right choice. These specifications might include the camera, battery, display, and processor. Similarly, when investing in stocks, the market capitalisation of companies is one of several factors that can guide you towards better investment decisions. But what is market capitalisation?

Market capitalisation, sometimes referred to as ‘market cap’, is the market value of a company’s outstanding shares. It is calculated by multiplying the number of outstanding shares of a given company by the current market price of one of its shares.

The market cap of a company is a helpful metric in deciding whether you want to add its stock to your portfolio, as it gives you a better understanding of the risk-return profile of the stock.

Categorisation of stocks based on market cap

Companies are categorised into large-cap, mid-cap, and small-cap companies based on their market capitalisation.

-

Large-cap

In the US stock market, companies with a market cap of $10 billion or above are large-cap companies, and in the Indian stock market, companies with a market cap of ₹20,000 crore or above are considered large-cap.

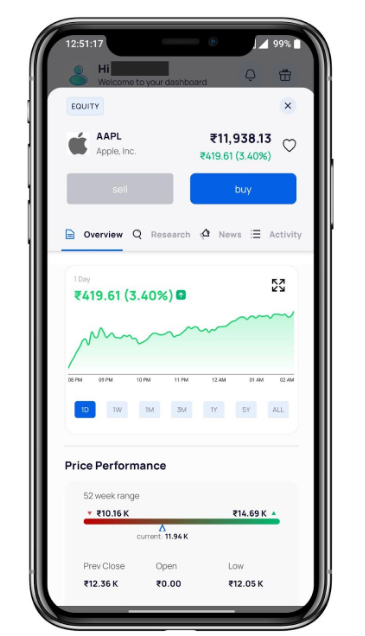

Large-cap stocks (i.e. stocks of large-cap companies) are known to be more stable and secure as they belong to well-established companies with strong financial fundamentals. Such companies are often industry leaders. Some examples of large-cap stocks include Apple, Amazon, Berkshire Hathaway, JPMorgan Chase, and Nike. You can easily invest in these companies (as well as other US companies) through an advanced online trading app.

-

Mid-cap

Companies with a market cap of $2-10 billion and ₹5,000-₹20,000 crore in the US and Indian stock markets respectively are usually considered to be mid-cap companies.

Mid-cap stocks tend to be more volatile than large-cap stocks, but still more stable than small-cap stocks. While they often belong to large corporations with proven financial track records, these companies still have scope for significant growth and expansion. Companies such as Skechers, Bath & Body Works Inc., and Etsy Inc. are mid-cap companies.

-

Small-cap

Small-cap companies are those that have a market cap of less than $2 billion in the US stock market and less than ₹5,000 crore in the Indian stock market.

Small-cap stocks carry a high level of risk and are far more volatile than large-cap and mid-cap stocks. On the plus side, however, they also have significant growth potential and are well-suited for investors with a high risk appetite. Some examples of small-cap stocks, according to Forbes, include Hudson Technologies, Vaalco Energy, SIGA Technologies, and Cross Country Healthcare.

Such a categorisation of companies is helpful because companies in the same market cap category tend to have similar features and financials, which makes the decision-making process easier when it comes to investing in them.

Several major market indices, such as the S&P 500 and Nifty 50, are also market-cap-weighted. This means that constituent companies with higher market caps have more of an influence on the index because they have a higher percentage weight in the index.

How to use market cap data to make better investment decisions?

The market cap of a company provides valuable insights regarding its market value, size, growth potential, stability, and risk. Here’s how you can use market cap to make better investment decisions:

-

Determine the stock’s stability and volatility

You can use a company’s market cap to decide whether its stock aligns with your risk tolerance level. Large-cap companies are generally more stable and tend to hold up better during periods of market downturns, while small-cap stocks can be sharply volatile. Mid-cap stocks fall somewhere in between when it comes to the risk level associated with them. However, during strongly positive periods, small-cap stocks might outperform large-cap stocks.

If you are an aggressive investor, you should consider adding some small-cap stock ETFs in your portfolio, but if you are more conservative, then large-cap stocks would be better suited for you. As always, diversification and strategic asset allocation across stocks with different market caps based on your risk tolerance level and financial goals is essential.

-

Assess growth potential and competitive strength

Image by Freepik

Large-cap companies, while stable, typically have less room for growth as they are already well-established and mature. They tend to have consistent financials, and could be paying dividends. Small-cap companies, on the other hand, could have immense growth potential, usually don’t pay dividends, and typically focus on expansion.

You can also use a company’s market cap to compare it to its peers to understand how competitive the company is. If a company has a larger market cap than its competitors but lower earnings and growth projections, then it might not be a wise investment as its growth may be stagnating. Market cap is also used in a variety of important financial ratios, such as the price-to-book value, which can help you assess a stock’s valuation better.

Investing based on market cap

Before you invest in any company, it is important to look at several financial data points that can help you make a more informed decision, and market cap is only one of them. You shouldn’t make a decision based on a company’s market cap alone — instead, use it along with other metrics such as earnings, revenue growth, and the price-to-earnings ratio to decide if a potential investment is likely to align well with your target asset allocation and overall investment strategy.

In conclusion, large-cap stocks can provide stability, steady returns, and potential dividends, while mid-cap stocks offer a balance of growth potential and stability. Small-cap stocks have the highest growth potential but also carry the highest risk. Ultimately, the key to success is to build a well-diversified portfolio that includes a mix of large-cap, mid-cap, and small-cap stocks that aligns with your financial goals and risk tolerance. Remember to do your research, stay informed about market trends, and remain patient and disciplined through market fluctuations. By following these principles, you can potentially achieve your long-term financial goals and build a secure financial future.

Author: Yogesh Kansal – Bio